Table of Content

For alternative minimum tax purposes, however, you could deduct the interest on these amounts only if the home equity loan proceeds were used to buy or improve your first or second residence. There are limits on the amount of home equity loan and lines of credit interest that can be deducted because the new tax law caps the total amount of home-related interest that can be written off. Interest on mortgage debt up to $750,000 can be deducted on homes purchased after Dec. 15, 2017.

The new law capped the amount to only $10,000 for all the aforementioned deductions from 2018 to 2025. The rule also discourages taxpayers from dodging these new limitations. Some might choose to prepay their 2018 state and local income taxes in 2017. The bill, though, does not mention anything about prepaying 2018 property taxes. First, the money must be used for home improvements or renovations. For example, you cannot take the deduction if you are using home equity proceeds to pay for personal expenditures or to consolidate credit card debt.

For some, interest is still deductible despite the Tax Cuts and Jobs Act

It might even provide some tax benefits since the interest you pay is sometimes deductible. But if you use the money to pay off credit card debt or student loans — or take a vacation — the interest is no longer deductible. But the Internal Revenue Service, saying it was responding to “many questions received from taxpayers and tax professionals,” recently issued an advisory. According to the advisory, the new tax law suspends the deduction for home equity interest from 2018 to 2026 — unless the loan is used to “buy, build or substantially improve” the home that secures the loan. Under prior tax law, a taxpayer could deduct “qualified residence interest” on a loan of up to $1 million secured by a qualified residence, plus interest on a home equity loan up to $100,000.

Frequently cited reasons include fire, casualty, natural disaster or other disturbances. The agency may also accept death, serious illness, incapacitation or unavoidable absence of the taxpayer or an immediate family member. As a relatively comprehensive new tax law, the TCJA will likely be subject to a variety of clarifications before it settles in.

Home Equity Loans and the Cap on Home Loan Tax Deductions

When you sell your primary residence, you can make up to $250,000 in profit if you’re single, or $500,000 if you’re married, and not owe any taxes on those gains. Most people are eligible for this exclusion, but you must have lived in your home for at least two of the five years before you sell. But the re-fi you were planning on using to pay off those credit cards?

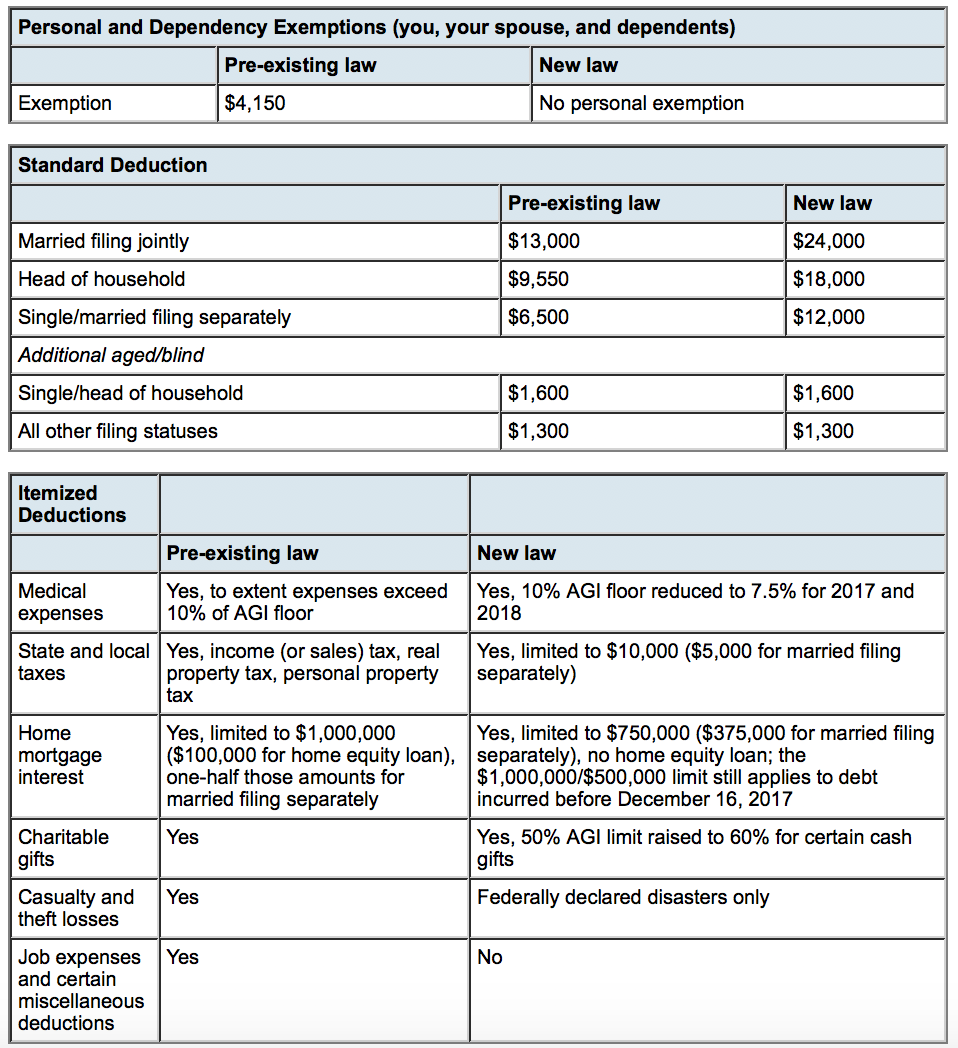

If loans exceed these limits, the amount of interest representing the first $375,000 of loans can be deducted, and the remainder would be nondeductible. State and Local Taxes – The itemized deduction for state and local income taxes AND property taxes combined is limited to a total of $10,000 starting in 2018. Before the TCJA was enacted, you could also deduct interest on up to $100,000 of home equity debt for regular tax purposes (or $50,000 if you used married-filing-separately status) — regardless of how you used the loan proceeds.

How Much Does H&r Block Charge To Do Taxes

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

With these increases many more taxpayers will take a standard deduction rather than itemize. Interest on home equity loans or home equity lines of credit are only deductible under the new law if the debt was used to “buy, build or substantially improve” the home secured by the loan. The student loan interest deduction allows a tax break of up to $2,500 for interest payments on loans for higher education. A home equity loan or a HELOC can be a convenient source of funding when you want to spruce up your home. Snagging a tax deduction for the interest that you pay is an added perk. As with any other loan, however, take the time to compare interest rates and loan terms from different lenders to find the best deal possible.

Our mission is to protect the rights of individuals and businesses to get the best possible tax resolution with the IRS.

However, because your $80,000 HELOC was taken out in 2018, the TCJA $750,000 limit on home acquisition debt apparently precludes any deductions for the HELOC interest. That’s because the entire $750,000 TCJA limit on home acquisition debt was absorbed by your grandfathered $800,000 first mortgage. So, the HELOC apparently must be treated as home equity debt, and interest on home equity debt can’t be treated as deductible qualified residence interest for 2018 through 2025. Under the old rules, taxpayers weren’t required to make a distinction between using home equity debt for home improvements vs. other uses — unless they were subject to the alternative minimum tax .

In response to the ambiguity, the Internal Revenue Service recently issued guidance on how to handle deducting interest paid on home equity debt under the new tax law. The IRS clarifies that taxpayers can still deduct interest on home equity loans, lines of credit or second mortgages, regardless of the technical loan label or name, and that it is the use of the loan proceeds that matters. The game-changer, however, is that many homeowners will see a higher tax break by taking the standard deduction, which has doubled to $24,000 for married taxpayers filing jointly. For single filers it’s $12,000, almost double what it was in 2017. So unless your mortgage interest and other itemized deductions total at least that much you're better off just taking the standard deduction. Prior to the recent tax law changes, taxpayers were allowed to deduct qualifying mortgage interest on loans up to $1 million, plus the interest on an additional $100,000 in home equity debt.

Starting with tax year 2018, state and local taxes, including property and income or sales taxes, are capped at a total of $10,000 combined. Interest on home equity debt is tax deductible if you use the funds for renovations to your homethe phrase is buy, build, or substantially improve. Whats more, you must spend the money on the property in which the equity is the source of the loan. If you meet the conditions, then interest is deductible on a loan of up to $750,000 . Passage of the Tax Cuts and Jobs Act in December 2017 has led to confusion over some longstanding deductions.

The same goes if you are taking out a loan and letting the money sit in the bank as your emergency fund. Whats more, the renovations have to be made on the property on which you are taking out the home equity loan. You cannot, for example, take out a loan on your primary residence and use the money to renovate your cottage at the lake. For 2018 through 2025, the new tax law generally allows you to treat interest on up to $750,000 of home acquisition debt as deductible qualified residence interest.

But unlike most mortgages and mortgage payments, the size of the debt and interest payments forced onto the acquired company often bear no relationship to its ability to pay. Every other cost of the company—including employment, wages and long-term investment—must often be slashed just to pay the interest. The IRS lumps HELOCs and mortgages together when it comes to determining whether you’re able to deduct the interest from these loans. If you’ve paid off your mortgage, then you’re still able to deduct your HELOC interest as long as you meet the other requirements, such as only using the funds for home upgrades. Note that $750,000 is the total new limit for deductions on all residential debt. If you have a mortgage and home equity debt, what you owe on the mortgage will also come under the $750,000 limitif its a new mortgage.

No comments:

Post a Comment